The UK's Focus on Company-registered New Car Sales Limits Impact of a Revived Plug-in Grant

With most new EVs flowing through company car channels, how much impact would a revived retail plug-in grant really have on adoption?

While company-registered cars make up only 9% of the UK's 33 million cars, 63% of 2024 new car sales went to companies (i.e., either in commercial use including company cars and salary sacrifice or leased to private individuals). For new BEV/PHEV sales, that ratio swells to over 80%, at least partly due to benefit-in-kind tax relief enjoyed by zero emission cars.

As the penetration of BEV/PHEV within new car sales continues to increase (as mandated by UK regulation), that path of most new car sales through the company registered bucket will continue to dominate, limiting both the number of new BEV/PHEVs sold directly through the retail channel and the potential impact of purchase price support like the UK's Plug-in Car Grant that was terminated in 2022.

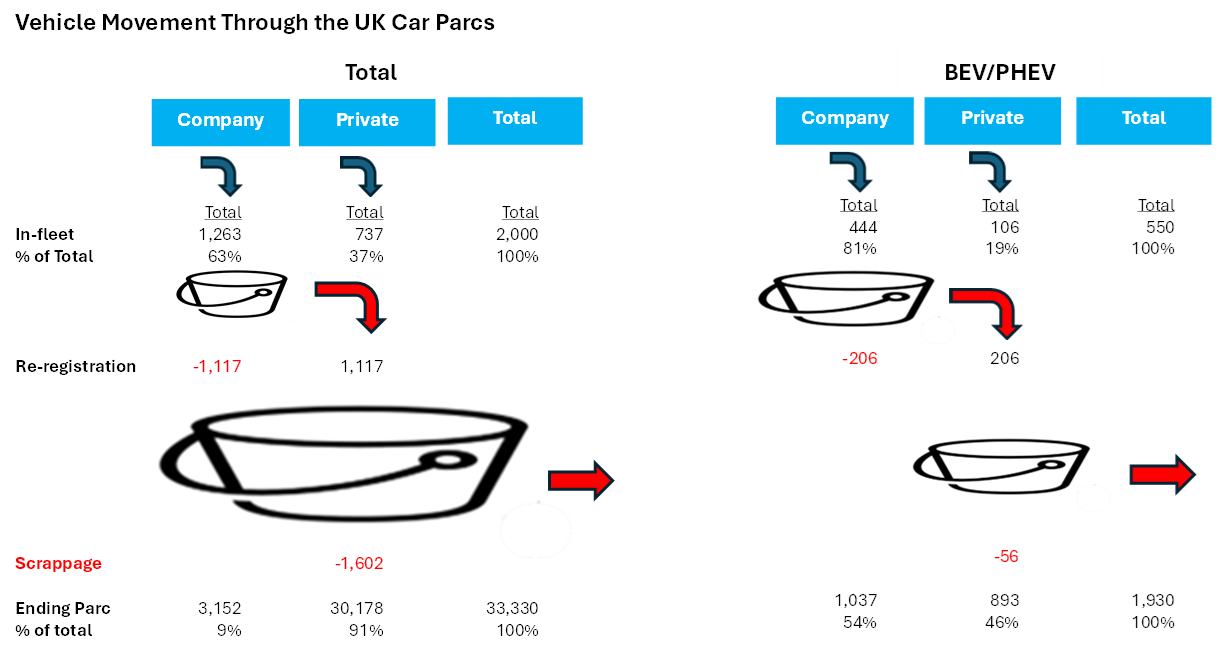

Vehicle Movement Through the UK Car Parc

The image below reflects movement of the UK's 33 million cars (including nearly 2 million BEV/PHEVs) in, through and out of the national parc in 2024.

Some other key observations of the total car parc in 2024 (left hand table) include:

- Company registered cars generally remain in that bucket for 2 to 5 years before being sold on into the used market and re-registered to private owners.

- Of the 1.8 million cars newly registered to private owners, only 737 thousand or less than 40% were brand-new vehicles with the remaining 1.1 million re-registered from the company car bucket.

So, while nearly 2/3 of all new car sales initially pass through the company registered bucket before "flowing" through the used car market to private registrants, only 1/3 go direct to consumers through the retail market.

Within the BEV/PHEV segment (right-hand table above), the distribution of new sales is far more disproportionately weighted, with more than 80% registered to companies. In a sense, that BIK benefit to BEV/PHEV in company use (again, including company cars, salary sacrifice and BEV/PHEVs leased by private individuals) serves as a de facto retail price incentive.

While those seeking government action in reinstating retail price incentives like the now defunct Plug-in Car Grant rightly point out that consumers in the retail channel are demanding only less than 20% of new BEV/PHEVs without price support, we should keep in mind that the retail channel for all new cars is only ever about 1/3 of annual sales.

It does seem unfair that benefit in kind tax efficiency is only available to those with access to a company car or salary sacrifice scheme. A sense of "equity" should compel extension of public subsidy to those with no access to new BEV/PHEV other than the retail market.

However, we mustn't over-anticipate the impact that price incentive might have on both retail demand and the ability of manufacturers to meet BEV/PHEV sales mandates. That burden remains with:

- Manufacturers to make electric vehicles that satisfy drivers' taste and driving patterns at a reasonable cost point and

- Investors and chargepoint operators to develop the charging network that satisfies BEV/PHEV drivers' demand for energy.