What is inhibiting the uptake of electric vans?

Amid conflicting and often inflammatory headlines, what is the real state of our transition to electric vehicles?

Amid conflicting and often inflammatory headlines, what is the real state of our transition to electric vehicles (EV)? Across Europe, government mandate is driving us toward an inflection point after which demand for EVs and the charging infrastructure that refuels them will increase dramatically to a zero-emission future.

Commercial vans are fundamentally different from cars. They’re driven nearly every working day; they do at least twice the annual mileage that a car does, and because they’re ultimately a tool used in serving their operators’ customers, they have little flexibility in the use case by which they’re driven.

In “ZEV Mandate – How’re We Doing?” I discussed how the UK is generally on track with its mandated 2024 trajectory for new e-cars. The Department for Transport’s (DfT) public consultation on its Zero Emission Vehicle (ZEV) Mandate is an appropriate response to market concerns, and I anticipate a progressive result addressing the Society of Motor Manufacturers and Traders (SMMT) call for “urgent intervention to safeguard the sector and Britain’s zero-emission vehicle transition”.

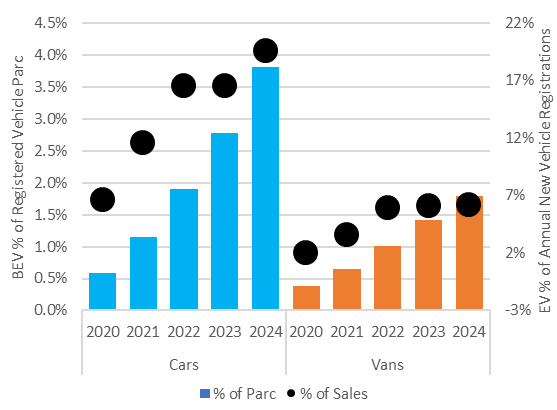

But while cars are performing well, what is the progress of e-vans? While battery electric vans (BEVs) represented 1 in 4 new car registrations in 2024, BEV penetration of new vans and other light commercial vehicles (LCVs) is far behind, at roughly 6%, well below the ZEV mandate trajectory of 10%.

What’s inhibiting the uptake of BEV vans?

The differences between personal vehicle and van use outlined in my opening help define factors inhibiting the uptake in BEV technology among vans:

- Vehicle capability: Actually, this is not as troubling a factor as one might think. While BEV, battery and charging technology certainly satisfy the use cases by which cars are driven, they’re also quite suitable for most van use cases.

Royal Mail announced in January the in-servicing of its 6,000th BEV van. BT Group also announced in January its largest-ever commercial EV order of around 3,500 eLCVs to its 27,000 fleets of Openreach branded vans. While there are certainly use cases for which BEV doesn’t yet provide a suitable answer, Royal Mail and BT (as well as other notable logistics, engineering, retail and manufacturing fleet operators), certainly demonstrate that range, load bearing and other characteristics of BEV satisfy their needs.

- Access to energy: Electric vans charge cheaply and conveniently at their operators’ depots. Unfortunately, estimates say that no more than 20% of the UK’s five million vans overnight in a depot. The rest are almost entirely operated by small and medium-sized enterprises (SMEs) and overnight at the driver’s home with low access to home or convenient on-street charging.

In the meantime, BEVs will largely require reliable, conveniently located, and competitively priced rapid or ultra-rapid resources (I’m starting to hear the term “hyper rapid”). While I’m sometimes presented with the concept of shared charging infrastructure, I think it is far more likely that “shared” means public charging on a retail basis. Unfortunately, there’s not a lot of this around, and even less of it is suitable for commercial vehicles.

- Funding viability and delayed development of the second-hand market: BEVs suffer from higher retail prices but benefit from lower filling and maintenance costs; their total cost of operating (TCO) can be equal, but upfront costs are higher.

New technologies like BEV enter the nation’s van market through commercial leases by which larger operators fund their fleets. Subsequently, that new technology disseminates into the wider SME market through the second-hand sales of off-lease vans. Without a robust second-hand market, financiers of those initial leases can’t efficiently identify residual values expected at lease end that largely determine monthly payments.

High prices depress the appetite for these new vehicles, slowing down new vehicle sales and stretching the useful life of incumbent diesel vehicles. This ultimately results in higher operating costs against already thin profits. As the robust second-hand market supplies SMEs that operate perhaps 75% of all vans in the UK, the slowdown in new van registrations has a domino effect, stretching vehicle age and escalating TCO throughout the national fleet.

So, what will happen?

Arguably, neither of these last two inhibiting factors is addressed by the ZEV Mandate. In fact, both will continue to impede compliance with regulation, no matter the extent of related penalties. I expect that the public consultation around terms of the ZEV Mandate may accommodate the delay in the uptake of eLCVs, but that’s not a good thing as the UK’s van fleet, which comprises only about 12% of all UK vehicles, does as much as 25% of the miles and emits a correspondingly large percentage of greenhouse gas emissions.

Furthermore, the interim stretching of useful life that escalates TCO will very quickly degrade operators’ profitability, leading to a reduction in the number of operators (either through bankruptcy or simply having had “enough.”)

The Zero Emission Van plan set out by BVRLA, AFP, Logistics UK, RechargeUK and the EV Café lays out “key asks” in supporting the ZEV Mandate objective of 70% eLCV penetration of new vans by 2030. The first two of these include a public sector address of increased fiscal support for BEV uptake (by larger fleets as well as SMEs drawing from the emerging second-hand market) and regulatory and fiscal support for improved charging. These are necessary interventions, and their need will eventually extend from vans to include heavy-duty lorries and other commercial vehicles.

Steer has been working with Transport for the South East (TfSE) on a pioneering approach to breaking an impasse between demand (i.e. van operators that can’t convert to BEV without a reliable, convenient and competitively priced charging provider) and supply (i.e. private investment) by robustly identifying nascent demand to attract investment in commercially viable projects. This work will become increasingly critical as I understand from the Association of Fleet Professionals (AFP) that the constrained supply of diesel vans (a function of the ZEV Mandate) is already causing operators to stretch the life of their incumbent vehicles, which will quickly raise operating costs against already very fine profit margins.

Outside of policy interventions, our work with TfSE is a private-sector address, marshalling investment in commercially viable projects that accelerate the supply of charging resources “jump-started” by public-sector policy.

The electrification of vans and other commercial vehicle classes is critical to the UK’s energy and environmental transition. These inhibiting factors will prove tough to overcome and painful to vulnerable fleet operators. I don’t have many (or even any) answers, but the attraction of private capital to infrastructure development and vehicle finance seem critical parts of the puzzle.

Stay ahead in the EV transition.

Join us for the Ramping Up event series, where industry experts tackle the most significant challenges and opportunities in EV adoption, charging infrastructure, and investment.

🔗 Sign up for upcoming sessions and catch up on past discussions: www.steergroup.com/rampingup